Money Management Plan

"Many traders think they need a lot of money to start trading and make big profits. From my experience, a beginner can start with just $250 to $300 while using good money management. You should aim for a minimum Risk Reward Ratio of 1:3. This means you risk $10 to make at least $30. Do not risk $10 to earn only $10 or $5."

Below table is an example of a money management plan that I use to manage my money wisely. Please remember: This is not a financial advice; it is for educational purposes only. You will experience losses while trading, and that's normal. If you follow a good money management plan, your wins will outweigh your losses. I aim for a 1:3 Risk Reward Ratio all the time. This means for every dollar I risk, I try to make three dollars. This approach helps me stay in control and protect my money.

When you finish this program, you will be able to create your own trading strategies and find out which indicators work best for you. You can aim for a win rate of at least 40% to make a profit. Over time, your win rate will increase as you improve your strategy, so it’s important to stay disciplined.

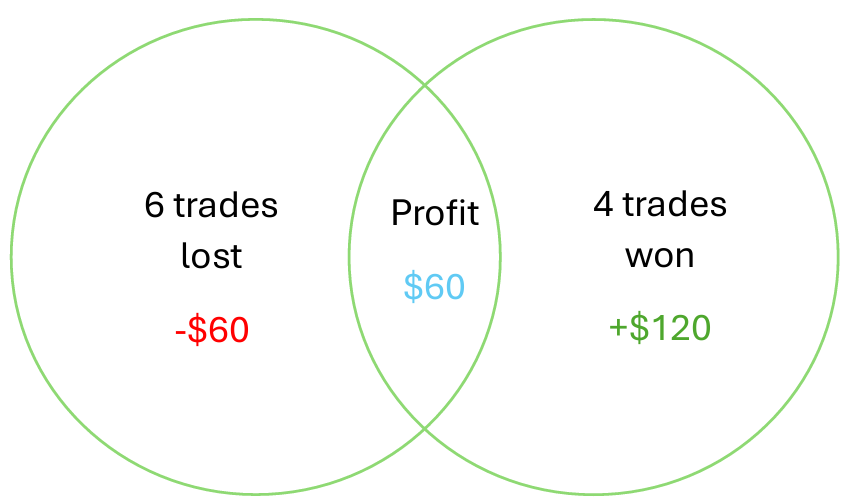

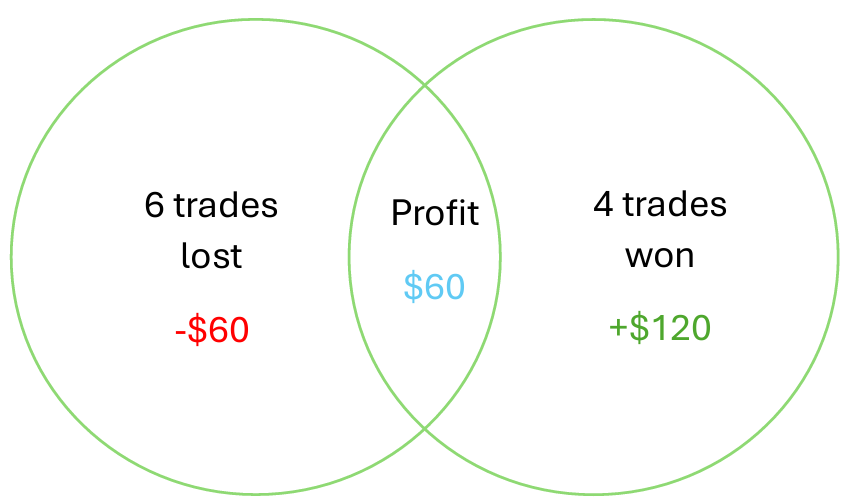

Even with a win rate of 40%, you can still make a profit by following a solid money management plan. For example, take a look at the figure below. You will see that if you lose 6 out of 10 trades, you can still end up making money. You took 10 trades with a Risk Reward Ratio of 1:3. You risked $10 to earn $30 each time. You lost 6 trades (6 x -$10 = -$60) and won 4 trades (4 x +$60 = +$120). When you calculate the difference, you made a profit of $60. Therefore, you are still in profits and your capital is safe. Always stick to your money management plan, as discipline is essential for staying profitable in trading.

Here are some additional effective strategies for setting up your money management plan:

Define Risk Tolerance: Assess your risk tolerance based on your financial situation, trading experience, and psychological comfort.

Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses.

Calculate Risk-to-Reward Ratios: Before entering a trade, calculate the risk-to-reward ratio. Aim for a minimum of 1:3, meaning for every dollar you risk, you aim to make three dollars.

Adjust Lot Sizes Based on Performance: If you are on a winning streak, consider gradually increasing your lot sizes, while being cautious. Conversely, reduce your lot sizes after a series of losses.

Regularly Review Your Plan: Periodically assess your money management plan to ensure it aligns with your trading goals and market conditions. Adjust as necessary based on performance and changing risk tolerance.

Stay Disciplined: Stick to your money management rules, even when emotions run high. Discipline is key to maintaining your trading capital over time.

Educate Yourself: Continuously learn about money management strategies and risk management techniques. Books, self-researches, and trading communities can provide valuable insights.

By implementing these strategies, you can create an effective money management plan that protects your capital, enhances your trading discipline, and contributes to long-term profitability.

_edited.jpg)